The income-expenditure account of the business organization is related to the corresponding accounting period. The utility of these ends in the relevant accounting period. If your business is a corporation, you will not have a drawing account, but if you paid stockholders, you will have a dividends account. If you paid dividends for the month, you will need to close that account as well. For sole proprietorships and partnerships, you’ll close your drawing account to your capital account, because you will need to reduce your capital account by the draws taken for the month.

What are Closing Entries and How to Record them in Accounting?

- An accounting year-end which is not the calendar year end is sometimes referred to as a fiscal year end.

- A net loss would decrease retained earnings so wewould do the opposite in this journal entry by debiting RetainedEarnings and crediting Income Summary.

- The closing entries are the last journal entries that get posted to the ledger.

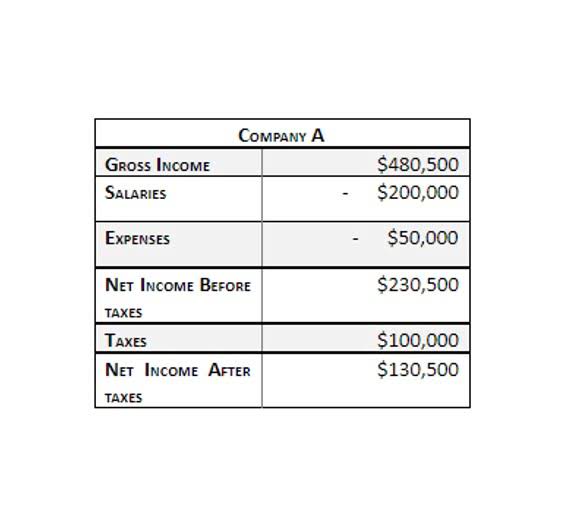

- The following example shows the closing entries based on the adjusted trial balance of Company A.

- Well, dividends are not part of the income statement because they are not considered an operating expense.

Notice that the balance of the Income Summary account is actually the net income for the period. Remember that net income is equal to all income minus all expenses. Enter “0” for a covered loan or application related to a multifamily dwelling that does not contain any such income-restricted individual dwelling units. Numbers calculated to beyond three (3) decimal places may either be reported beyond three (3) decimal places, up to 15 decimal places, or rounded or truncated to three (3) decimal places. Decimal place trailing zeros may either be included or omitted.

- Use Code 3 if the applicant or borrower, or co-applicant or co-borrower, does not provide the information in an application taken by mail, internet, or telephone.

- The Income Summary account has a new credit balance of $4,665, which is the difference between revenues and expenses (Figure 5.5).

- The balance in the Income Summary account equals the net income or loss for the period.

- Financial statements are referenced to the year-end date.

- The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period.

- Use Code 5 in the co-applicant field if there are no co-applicants or co-borrowers.

- Now, the income summary account has a zero balance, whereas net income for the year ended appears as an increase (or credit) of $14,750.

Get in Touch With a Financial Advisor

- In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts.

- Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow.

- The first entry closes revenue accounts to the Income Summary account.

- On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below.

- Temporary accounts can either be closed directly to the retained earnings account or to an intermediate account called the income summary account.

- We’ll call this closing entry A, just to keep track of it.

There are various journals for example cash journal, sales journal, purchase journal etc., which allow users to record transactions and find out what caused changes in the existing balances. Closing entries are mainly used to determine the financial position of a company at the end of a specific accounting period. Notice that the balances in interest revenue and service revenue are now zero and are ready to accumulate revenues in the next period.

Step 3: Clear the balance in the income summary account to retained earnings

Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings. The income statementsummarizes your income, as does income summary. If both summarizeyour income in the same period, then they must be equal.

Trial Balance

- For example, an Automated Underwriting System Result of Accept/Eligible should be coded as 18, and not listed as “Accept/Eligible” in the free form text field.

- Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries.

- Although it is not an income statement account, the dividend account is also a temporary account and needs a closing journal entry to zero the balance for the next accounting period.

- The income-expenditure account of the business organization is related to the corresponding accounting period.

- The eighth step in the accounting cycle is preparing closingentries, which includes journalizing and posting the entries to theledger.

Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company. We don’t want the 2015 revenue account to show 2014 revenue numbers. Temporary closing entries accounts are used to record accounting activity during a specific period. All revenue and expense accounts must end with a zero balance because they’re reported in defined periods. A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months.

These entries are made to update retained earnings to reflect the results of operations and to eliminate the balances in the revenue and expense accounts, enabling them to be used again in a subsequent period. As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200.

The income summary account acts as a temporary holding place for the net income or loss for the period. In the next accounting period, these temporary accounts are opened again and normally start with a zero balance. In a general financial accounting system, temporary or nominal accounts include revenue, expense, dividend, and income summary accounts.

In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year. This concept is consistent with the matching principle. Enter “NA” if the requirement to report introductory rate period does not apply to the covered loan or application that your institution is reporting. If fewer than five (5) ethnicities are provided by the applicant or borrower, or by any co-applicant or co-borrower, leave the remaining Ethnicity of Applicant or Borrower data fields blank.