Notice the net income of$4,665 from the income statement is carried over to the statementof retained earnings. Dividends are taken away from the sum ofbeginning retained earnings and net income to get the endingretained earnings balance of $4,565 for January. This endingretained earnings balance is transferred to the balance sheet. To get the numbers in these columns, you take the number in the trial balance column and add or subtract any number found in the adjustment column.

How to cut the cost on your financial transactions

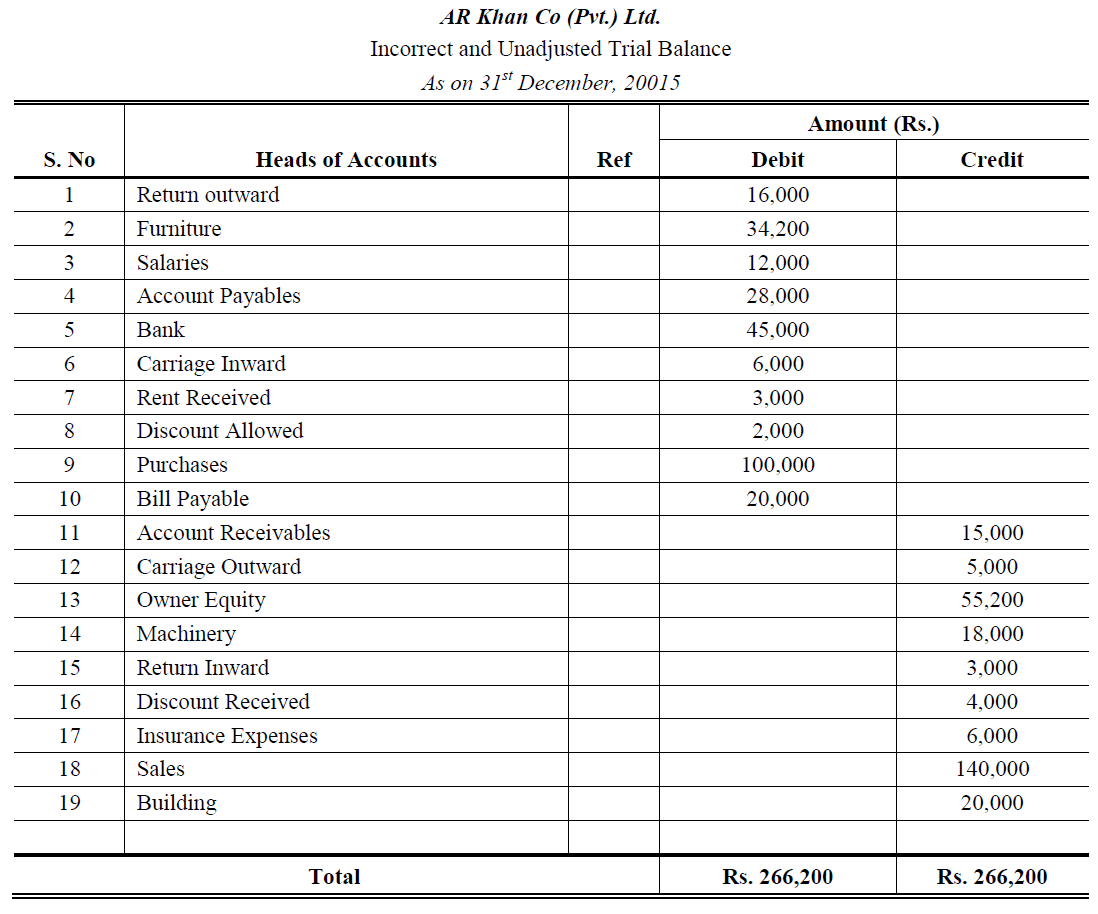

- As with all financial reports, trial balances are always prepared with a heading.

- To prove the quality of the total debit and credit balances, accountants prepare an adjusted trial balance.

- A trial balance is an accounting report you put together at the end of an accounting period to ensure the general accounting ledger is correct and the total debits match the total credits.

- The statement of retained earnings (which is often a component of the statement of stockholders’ equity) shows how the equity (or value) of the organization has changed over a period of time.

- Once we add the $4,665 to the credit side of the balance sheet column, the two columns equal $30,140.

If you look at the worksheet for Printing Plus, you will notice there is no retained earnings account. That is because they just started business this month and have no beginning retained earnings balance. The next step is to record information in the adjusted trial balance columns. This means that for this accounting period, there was a total inflow (debit) of $11,670 into the cash account. Pepper’s Inc. totalled up all of the debits and credits from their general ledger account involving cash, and they added up to a $11,670 debit. An unadjusted trial balance is what you get when you calculate account balances for each individual account in your books over a particular period of time.

Format

What exactly is that accumulated depreciation account on your balance sheet? At some point, you’ll want to make sense of all those financial transactions you’ve recorded in your ledger. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Financial statements drawn on the basis of this version of trial balance generally comply with major accounting frameworks, like GAAP and IFRS.

Link to Learning

Preparing an adjusted trial balance is the fifth step in the accounting cycle and is the last step before financial statements can be produced. Before computers, a ledger was the main tool for ensuring debits and credits were equal. Take a couple of minutes and fill in the income statement andbalance sheet columns. Next you will take all of the figures in the adjusted trialbalance columns and carry them over to either the income statement columns or the balancesheet columns. The adjustments total of $2,415 balances in the debit and creditcolumns.

If we go back and look at the trial balance for Printing Plus, we see that the trial balance shows debits and credits equal to $34,000. Once you have a completed, american survival guide in front of you, creating the three major financial statements—the balance sheet, the cash flow statement and the income statement—is fairly straightforward. At this point you might be wondering what the big deal is with trial balances. Did we really go through all that trouble just to make sure that all of the debits and credits in your books balance? You’re now set up to make financial statements, which is a big deal.

Trial balance: Definition, purpose, and example

Ifthe final balance in the ledger account (T-account) is a creditbalance, you will record the total in the right column. Companies can use a trial balance to keep track of their financial position, and so they may prepare several different types of trial balance throughout the financial year. A trial balance may contain all the major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses. Once a book is balanced, an adjusted trial balance can be completed.

A trial balance is often the first step in an audit procedure, because it allows auditors to make sure there are no mathematical errors in the bookkeeping system before moving on to more complex and detailed analyses. Concepts Statements give the Financial Accounting Standards Board (FASB) a guide to creating accounting principles and consider the limitations of financial statement reporting. If you’re using a dedicated bookkeeping system, all of this work is being done for you in the backend. It will create a ledger of all your transactions and turn them into financial statements for you. After incorporating the $900 credit adjustment, the balance will now be $600 (debit). These examples will show you how to adjust an unadjusted trial balance looks like.

When preparing an incomestatement, revenues will always come before expenses in thepresentation. For Printing Plus, the following is its January 2019Income Statement. After the adjusted trial balance is complete, we next preparethe company’s financial statements. The adjustments total of $2,415 balances in the debit and credit columns. An income statement shows the organization’s financial performance for a given period of time. When preparing an income statement, revenues will always come before expenses in the presentation.