A home equity line of credit is far more such as a credit credit than that loan. Payments aren’t due up until there was a fantastic balance on the line from credit. Family guarantee lines of credit are often used to purchase instructions that are made a bit at once, such as for instance having https://simplycashadvance.net/loans/no-credit-check-installment-loans/ educational costs that is paid down just after a semester over the span of four years.

Since do-it-yourself and you may restorations programs shall be both you to definitely-time requests and continuing strategies that will be paid for a small bit at once, each other domestic collateral finance and you can family equity lines of credit each other are superb alternatives for financial support house projects. The kind of financial support you decide on depends on your own private issues:

- Their preparations to own promoting the home

- How long you plan to live in our home yourself

- The sort of home improvements you are making

- The amount of well worth brand new improvements increase your property

Property collateral credit line is always financing a continuous family renovate that is done area by room along side course of months or decades, if you find yourself a property collateral mortgage is often greatest to own investment one to-go out tactics such as this Circumstances kitchen remodel.

Household equity cannot occur within the vacuum pressure if you’re utilizing the money for a renovating otherwise home improvement enterprise. A venture including completing a loft or updating a home adds a lot of value to your residence, when you are a task eg restorations a house place of work although it can get add a number of worthy of to the existence cannot improve residence’s worth as often.

Your own go back-on-money (ROI) during the a property renovate ‘s the percentage of investment property into the a job that you are able to recoup if house offers. It is important to keep in mind that each other a good house’s equity plus come back towards the their investment are not actualized until you offer your house. So if you never ever intend to offer your property, family guarantee will get a whole new online game.

A middle-assortment bathroom remodel costs normally $12-20,100, according to statistics achieved from the Building work Journal. But with the typical Bang for your buck regarding 62%, the latest resident can incorporate high worth into house with your bathroom revision along these lines one.

Using home equity money to the a top-really worth do it yourself assists improve your home’s equity. You can use the additional security to help you acquire extra cash facing the house. For individuals who continue to generate improvements at your home, you possibly can make a confident cycle away from increasing your residence’s guarantee and it is worthy of, a process that happens hand-in-hand.

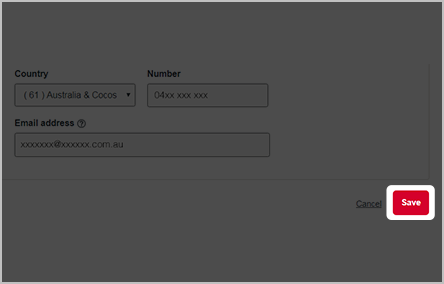

While the line of credit might have been recognized, the newest resident identifies in the event that of course, if to use the cash and you will is withdraw it regarding membership as needed

In the case of a property valued in the $300k which have a remaining mortgage out-of $150k, the newest citizen have $150k regarding guarantee at home and you may decides to purchase $50k during the a primary kitchen upgrade. The average Value for your dollar about resource try 65 %, therefore the venture adds $thirty-two.5k of value to your home. As homeowner today owes $200k with the domestic, it’s now valued from the $332.5k. The new homeowner have decreased the fresh new home’s full collateral from the simply $17.5k, and now provides a brand new $50k home into the a house you to definitely continues to have loads of equity.

House collateral taxation pros and you will option restorations financing alternatives

Although there try conditions, the interest paid back on the property collateral mortgage all year round can usually feel deducted on your own federal tax return. This gives property owners a choice of preserving some extra cash on a renovation that with a property equity loan to cover they, instead of securing a unique style of money. Domestic security financing supply property owners an easy way to pay almost every other, large notice loans at a diminished rate of interest having taxation-allowable appeal.