- Settling a beneficial 401(k) financing can create most monetary filter systems, particularly if unexpected costs arise.

Borrowing from your own 401(k) can provide a quick option to money your house pick, but it is imperative to evaluate these cons. Be sure to understand the regards to people financing otherwise withdrawal your invest in and make certain it aligns together with your enough time-term monetary requirements, not simply your hopes for homeownership.

Utilizing your 401(k) to purchase your earliest family is going to be a viable solution if approached meticulously. Instead of delivering home financing, you don’t need to keep in touch with a timeless bank or mortgage broker. Rather, you ought to consult with debt planner otherwise bundle officer so you’re able to establish a plan.

The first step: Consult your Bundle Officer

For each and every 401(k) bundle possesses its own number of rules and restrictions. Begin by information your unique plan’s legislation away from real estate purchases. There is exemptions to own distributions otherwise a loan. Your plan officer also provide detailed information into financing terms, difficulty withdrawals, and you may one associated charges otherwise punishment.

Step two: Determine extent Necessary

In advance of investing in delivering any money from your retirement membership, you should know just how much you need. This step may require coping with a large financial company to locate pre-acknowledged while having your financial allowance reviewed. Determine the exact matter you would like for your house purchase, like the down payment, settlement costs, and just about every other relevant expenditures. This will help you regulate how much to withdraw or acquire from the 401(k).

3: Measure the Economic Viability of employing Your own 401(k) to possess an advance payment

Have fun with economic believed units otherwise speak with a monetary coach in order to assess just how utilizing your 401(k) tend to apply at your retirement and you will full economic health. Check out the effect on their long-identity offers, potential penalties, and also the effect on disregard the gains. A monetary mentor makes it possible to weigh the huge benefits and you will cons to discover if this is the best option to suit your state.

Step 4: Choose between that loan and you can a detachment

Pick whether or not to take a loan otherwise an adversity https://paydayloanalabama.com/haleburg withdrawal from your own 401(k). That loan have to be paid back with attract but won’t sustain very early detachment penalties or taxation in the event the paid off punctually. An adversity detachment doesn’t need to become paid, nonetheless it could well be susceptible to taxes and you will possible punishment, that may somewhat slow down the amount you obtain.

Debt coordinator is able to give you insight into both of these alternatives. Generally speaking, should your account holder are able to afford the new payments and you will actually believe for the switching services, delivering that loan from the 401(k) more a detachment is advised.

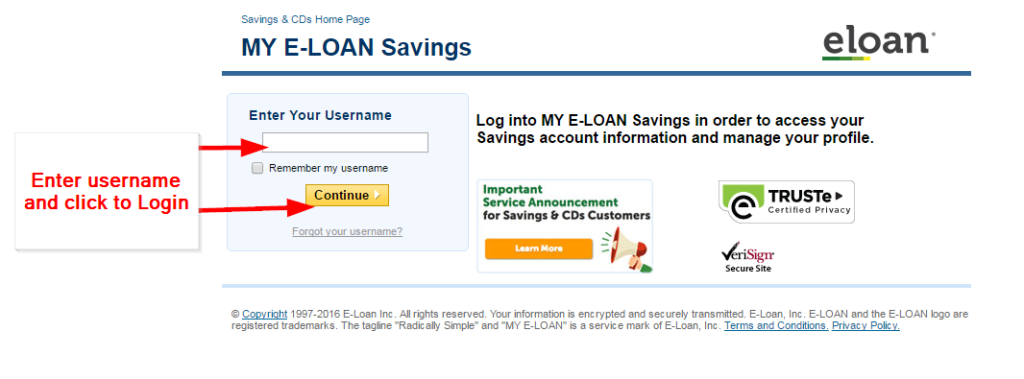

Step Five: Make an application for the borrowed funds or Withdrawal

After you have ount and type from 401(k) incorporate, apply during your package manager. This action normally involves doing specific models and you can bringing records to own your house buy.

For folks who opt for a loan, would a cost package that meets affordable. Just remember that , 401(k) financing usually have to be paid off within this five years, in the event this identity is extended to have a first household pick. Failure to repay the borrowed funds may cause they receiving treatment given that a nonexempt delivery.

Step Half a dozen: Understand the Tax Implications

Understand income tax effects associated with withdrawing or borrowing from the bank from your 401(k). Correspond with a monetary coordinator otherwise tax elite so that you learn just how much you might have to shell out and ways to eradicate your own obligations.

Step Seven: Screen pension Savings

If you find yourself advancing years may seem at a distance, very early think and you may preserving are essential. Tune just how credit otherwise withdrawing out of your 401(k) influences pension coupons. To change pension package contributions if necessary to make certain you might be however focused in order to satisfy their long-label economic desires.